DBID: “He Said, She Said”

- an “In My View” article by NIGEL WARD, updating the DBID integrity saga and presenting (with thanks to Councillor Eileen MURPHY [Ind.]) a response by Councillor Liz COLLING [Lab.] to some (but not all) of the many questions raised in connection with the Yorkshire Coast DBID levy.

~~~~~

I am pleased to be able to report, in considerable detail, on some repercussions following my article “DBID: Night of the Long Noses” (published Monday 7th October 2019), in which I highlighted the disparity between (i) a statement made by Councillor STONEHOUSE [Lab.], attributing to Councillor Liz COLLING [Lab.] (Portfolio Holder for Economy, Communities & Commercial) a highly inappropriate and coercive/threatening statement and, (ii) Council COLLING’s own evasive denials of same.

A reminder of Councillor STONEHOUSE’s assertion:

- “I’m sure that Councillor Colling said to me, actually, well, that if Whitby businesses don’t pay up, erm, then they won’t get the money spent there.”

Councillor COLLING has explicitly and emphatically denied having instructed ‘her’ “Councillors on the East side of Whitby to inform businesses (levy payers) they must pay their business levy or Whitby won’t get any thing” – which may answer the question posed by Councillor Alf ABBOTT [Con.], but most certainly does not answer the real question, which has already been asked – and dodged:

- “Did Councillor COLLING say what Councillor STONEHOUSE told the business people she said?”

Without a clear admission from Councillor COLLING, the form book tells us that this will devolve into to a classic “He said, she said” scenario – as I pointed out in my previous article – and then die a death, as it is no doubt intended to do.

On careful reflection, we must now recognise that Councillor COLLING has NOT denied the assertion made by Councillor Mike STONEHOUSE – i.e. that she (Councillor COLLING) had told him “that if Whitby businesses don’t pay up, erm, then they won’t get the money spent there”; she has denied, in response to Councillor Alf ABBOTT’s rather loose question, that she “instructed Councillors on the East side of Whitby to inform Businesses ( Levy payers ) They must pay their Business levy or Whitby won’t get any thing” – a very different matter indeed.

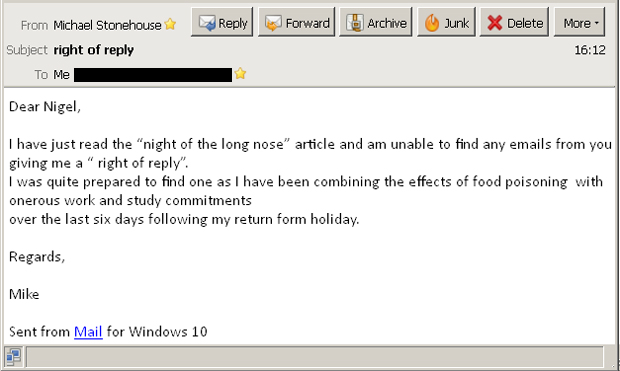

Councillor STONEHOUSE has now made contact with me to explain why he has been conspicuous by his silence since it became widely known that he had attributed the ‘pay up – or get nowt’ ultimatum to Councillor COLLING:

Note that Councillor STONEHOUSE does not does not deny having attributed the statement to Councillor COLLING. Nor does he withdraw his assertion.

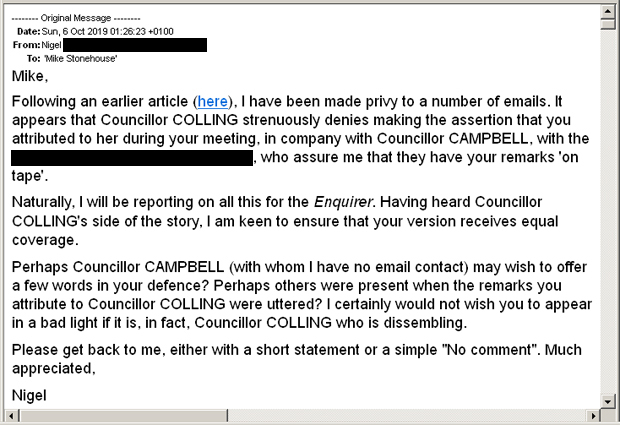

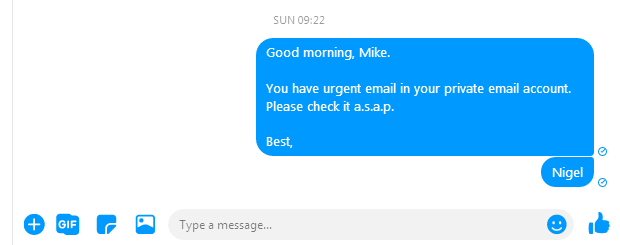

I have, of course, responded to Councillor STONEHOUSE, providing a copy of my original ‘right of reply’ email to him, and a screenshot of my Facebook alert to him, both of which I reproduce here:

No wriggle-room there.

Councillor STONEHOUSE has since responded for a second time, with complete transparency, no longer querying the fact that I did indeed offer him a ‘right of reply’, but making clear that he does not wish to make an official comment “at this stage” (then when?), so I accept that it would be unfair to him to reproduce his email in its entirety. (In any case, part of it refers to another, quite unrelated matter in which Councillor STONEHOUSE and I share a common interest).

However, it is very much in the public interest to disclose the key information that Councillor STONEHOUSE has specifically confirmed:

- “I do recall making a comment concerning being advised that non payment of the DBID by Whitby businesses would reduce DBID projects and spending for Whitby.”

Notwithstanding the omission of Councillor COLLING’s name, Councillor STONEHOUSE’s latest statement vindicates the two Whitby business proprietors to whom he made his original statement (which did include Councillor COLLING’s name). Of course, given the existence of the audio recording, Councillor STONEHOUSE could hardly “at this stage” do otherwise. Nevertheless, Councillor STONEHOUSE has been scrupulously open and co-operative and I give full credit to him for that.

At the same time, all this leaves little doubt that Councillor Liz COLLING has taken advantage of Councillor ABBOTT’s less-than-watertight question with her ‘tricky’ response; by which I mean that he asked the wrong question and Councillor COLLING dutifully dusted off her hands, exhaled a deep sigh of relief and obliged him with – the wrong answer.

In my view, Councillor COLLING has also been ‘tricky’ in her response to questions posed by Councillor Eileen MURPHY [Ind.], and others, insofar as (and she concedes this) she is merely repeating (without adding to) information already in the public domain – without reference to the statement attributed to her by Councillor STONEHOUSE. And still no response to my Open Letter to her of 29th September 2019 (thus discriminating against me). In short, nothing new – no “openness and transparency” at all.

The issue is this:

Councillor COLLING’s statement has been widely understood as threat or coercion. Certainly, the two local business proprietors, having identified themselves as being strenuously opposed to the DBID, took it as a warning: “Pay up – or spoil it for every tourism-related business in Whitby” – a typical divide-and-rule Council strategy. (Incidentally, if – and only if – the promised evidence materialises, I shall presently be reporting on allegations that the ballot may have been compromised by the highly questionable technique of selected businesses having been ‘sounded out’ as to which businesses should be included in , or excluded from, the ballot, in order to bias the ballot toward a ‘positive’ – from the DBID’s perspective – outcome. In my view, that could amount to electoral fraud. We shall see).

Question: If it was not Councillor COLLING’s intention to ‘lean’ on the Whitby anti-DBID campaign, how is it that she has not published a clarifying statement explaining that her remarks were not directed specifically at Whitby, the epicentre of resistance to the DBID; rather, they were directed equally to the entire area covered by the DBID? “Pay up – or spoil it for every tourism-related business in the entire DBID area”.

The cynics amongst the Enquirer readership will no doubt be asking the question, “What do you expect from a politician?”.

My answer: “Better than this!”

Councillor COLLING’s answer (the parts she wrote herself can be identified by the fact that she has a habit of either omitting full stops, or placing a space before them; the rest is presumably the work of an unidentified SBC Officer – there’s transparency for you):

FROM: Cllr.Liz Colling <Cllr.Liz.Colling@scarborough.gov.uk>

DATE: 9 October 2019 at 11:32:46 BST

TO: Cllr.Eileen Murphy <Cllr.Eileen.Murphy@scarborough.gov.uk>

SUBJECT: BID

Hi Eileen

Happy to meet to discuss if that would help? Just let me know

I have arranged for the DBID company to come to present to councillors and answer questions and concerns before the next full council meeting on November 4th .

The contents of this e mail are all a matter of public record and can be shared if you so wish

The BID company is a business led separate legal entity governed by its own board and governance established under the BID regulations of 2004

Here is a link to the regulations

http://www.legislation.gov.uk/uksi/2004/2443/contents/made

As you know the BID process and ballot took place in 2018 , under the previous council. The council has met its obligations under those regulations and we followed the correct process.

The council could have vetoed the proposal that would have to have happened in summer 2018 under Regulation 12. Redcar council did just that SBC and East Riding chose to let the scheme go to the ballot

Once the ballot result was declared in November 2018 the council had 28 days in which it could have stopped the BID process Regulation 9, SBC and East Riding chose not too

Levy payers had the right to appeal to the Secretary of State under that same regulation. There was an attempt to do this was not allowed to proceed

If any group of businesses is obviously free to do as they think best in terms of further challenge and the council will give an account of its actions if it is required to do so .

Going forward SBC cannot absolve itself from interest , we do pay our levy of £32,000 or thereabouts and as you know we have a seat on the board along with other statutory bodies . The voting rights are 81% businesses and 19% .

It is important to stress we do not control the BID company, we can influence, but as you can see from the voting structures we cannot carry any decision if the businesses on the board do not support that.

Changes to the BID are covered under regulations 16 and 17. Some changes require a new ballot, the detail will depend on the BID companies own governance. The question about when will the BID company change to raise a levy only from Tourist businesses is one that only the BID company can answer.

Regulation 18 has a provision in the regulations for SBC to decide if it wishes to require the BID company to give account if itself and potentially close in a scenario where it has made spending commitments it cannot meet. Given that the BID company is newly established and has not made many spending commitments we are not at that stage

Schedule 4 of the regulations details the rules that we must follow for the BID levy collection , we do not have a choice in this matter. The council will follow the law of the land and abide by the BID regulations

I thought it might be useful to put in one place the responses to the various questions on DBID that colleagues have asked on me in full council

Answers to question asked on September 16th

Q1. At the Council meeting on 1 March 2019 during the debate on a motion relating to DBID the following was minuted:“In response to a query by Councillor Siddons, the Monitoring Officer, Mrs Dixon confirmed that if the Secretary of State were to reject the appeal, then the DBID would go ahead, and then according to Councillor Nock’s amendment, the Council would take considered advice on how to address local businesses’ concerns and any other relevant matters.”

How did SBC “address local business concerns” when the appeal failed? What advice and from whom did the council take in order to address those concerns?

The Council has responded to all queries that have come in from concerned businesses in relation to the role it played in carrying out the ballot and any other requests through its usual information governance procedures and normal business processes. Businesses groups or individual businesses that have submitted queries or requests to the Council in relation to DBID organisational matters and processes, beyond the Council’s responsibility, have been directed to the DBID organisation.

Q2. As part of their ratification of the DBID levy collection process, East Riding of Yorkshire Council’s Cabinet agreed to recommend to Full Council that an amendment to the scheme of delegation for the relevant Director be made to specifically include the collection of BID levies.

Has SBC amended the scheme of delegation in its Constitution to authorise the collection and enforcement of the DBID levy?

I am informed that it is not necessary for any amendment to be made to the Council’s Constitution. It already provides the appropriate authorisation for the collection and enforcement of the levy.

Q3. In the period between 14/09/17 and 02/05/19 Scarborough Borough Council paid c. £88k to the Mosaic Partnership who was responsible for the management of the Yorkshire Coast DBID project. This had been subject to a lot of commentary by campaigners who oppose the DBID levy.

Could the Portfolio Holder clarify for the public record why SBC was responsible for these payments to the Mosiac partnership?

The payments were also listed as “rechargeable”. Could the Portfolio Holder confirm what proportion of the £88k was received from third party bodies who were contributing to the development of the DBID project?

Could the Portfolio Holder confirm the actual spending by SBC on the DBID project during that period?

The Council has not paid DBID £88,000 from rate payers’ money. The Council has received a total of £89,000 contributions from local businesses and local authorities towards the initial cost of bringing the DBID forward. This included a contribution of £15,000 from Scarborough Council – in accordance with the recommendations set out in the May 2017 Cabinet report (17/080). The Council paid Mosaic a total of £88,248.29 during the period September 2017 to May 2019. The remaining balance of £751.71 has subsequently been paid to the new Yorkshire Coast Business Improvement District company.

Q4. Given that DBID is a business led initiative, many of us were somewhat surprised that seats on the board were given to public bodies such as Scarborough Borough Council.

Could the Portfolio Holder clarify the role of these Directors, in particular the SBC representative on the board?

The stakeholders on the board are Scarborough Borough Council, East Riding of Yorkshire Council, North Yorkshire County Council, North York Moors National Park Authority and North Yorkshire Police – 20% of the board with a total of 19% of the votes. Local businesses have the remaining 81% of the votes. The Scarborough Borough Council representative, Director, Mr Richard Bradley is there to represent the Council’s interests as a levy payer of £33k pa, avoid duplication of effort (for example if the Council has already undertaken market research which would be of use to the DBID company) and to offer support where the Council has skills and expertise.

Does the involvement of SBC risk undermining the business led approach that the BID Company has said it will adopt?

No, I do not believe so.

Q5. Does the Council have any plans to apply for funding from the DBID Company?

The council will be working with businesses and community partners to ensure the best use of the monies through the DBID process for the benefit of the borough.

Statement on July 1st Councillor Colling presented her statement as Porfolio holder …….

Councillor Colling then provided an update on the Yorkshire Coast Destination Business Improvement District (DBID). Members were reminded that the DBID was a private sector led initiative, and that the DBID concept and funding was never designed to be ‘controlled’ by local government. Rather, it was about businesses coming together to create sustainable solutions to the management of an area where all relevant businesses paid and benefited. The Borough Council had been invited to be part of the development of the DBID and had been involved in the consultation process. Members had also been given the opportunity to attend two briefings which outlined the process both at the beginning and towards the end of the project. Reports around funding and support had been taken to both the Cabinet and full Council. Some local businesses had lodged an appeal against the ballot result in favour of the DBID. In May the Secretary of State had dismissed the appeal on the grounds it had not attracted the necessary support of at least 5% of businesses. Following concerns raised by businesses, the Borough Council was invited to review all of the consultation data and was satisfied that the DBID company had fulfilled all of its statutory obligations. The Council was happy with the due diligence carried out and that the company had worked in the best interest of the private sector and had followed the BID regulations of 2004. The Borough Council was bound by the same regulations and would join the Board of the DBID company as a stakeholder. In terms of the financial implications for the Council, on 16 May 2017 the Cabinet committed to fund £15k for the set up costs of the DBID company including £6k for running the ballot. The Council contributed a further £1k towards the feasibility study. This funding could not be reclaimed. To date, the DBID company had not required an advance on its levy income from the Council. The Borough Council owned 38 properties with a rateable value of over £12.5k, 32 of which were car parks. The cost in DBID levies to the Council based on values as at November 2018 was £31,158 per annum from a total rateable value of £2,079,300, that is, 2.4% of the total rateable value across the area. In accordance with the BID regulations of 2004, the Council would issue levy bills on 1 August. Any business which refused to pay the levy would be pursued in the same way as if it had not paid business rates. Members then put questions to Councillor Colling about the DBID. Confirmation was sought of the Council’s position in light of full Council’s resolution on 1 March to set aside all involvement with it until such time as the Secretary of State had determined the appeal. The Council would then consider its position along with the business community and take considered advice. Councillor Colling commented that following the Secretary of State’s decision to reject the appeal, the Council had obtained confirmation of its legal position as levy-collector. The Council was required under the 2004 BID regulations to collect the levies on behalf of the DBID company, otherwise the company could take legal action against the Council. Further, the Council was satisfied that the data used by the DBID company in the ballot was legitimate. Asked if the Council would consider invoking the clause in the BID regulations by which the Council could veto the DBID, Councillor Colling commented that this clause only pertained prior to the ballot, and could only be invoked in such circumstances as the DBID proposal conflicted with Council policy or it placed a significant disproportionate burden on certain ratepayers compared to others. Asked by what delegated authority the then Leader of the Council had cast the Borough Council’s vote in favour of the DBID, Councillor Colling responded that she understood that the Leader, Portfolio Holder for Corporate Investment, and Director with responsibility for tourism had cast the Borough Council’s votes but she would provide a more detailed written reply. Further, the Borough Council was in ongoing dialogue with the DBID company, but as yet no written agreement had been signed between the two organisations. Asked what financial and reputational risks the non-collection of the DBID levy posed to the Council as levy-collector, Councillor Colling undertook to provide a written reply in regard to the financial implications. However, it was the DBID company who retained responsibility for the initiative, and who would have to consider the implications of non-collection for their business plan. The Council as levy-collector with the support of the DBID company would enter into negotiations with businesses which refused to pay, but Councillor Colling would expect bailiffs to be used as a very last resort.

Written responses to questions asked July 1st

By what delegated authority did the Director with responsbility for Tourism and Portfolio Holders cast the Borough’s Council’s votes in respect of the Yorkshire Coast DBID? (Cllr Donohue-Moncrieff)

The Cabinet resolved on 16 May 2017 to support Welcome to Yorkshire Coast Tourism Advisory Board’s request for the Council to be the accountable body for the DBID, to fund a contribution of £15,000 and to delegate authority to the Director with management responsibility for tourism in consultation with the Portfolio Holder for Tourism and Culture to agree the terms under the scheme and to make arrangements for carrying out the ballot. This authority extended to the casting of the Borough Council’s votes as part of the ballot.The constitutional mechanism for such a delegation is found at Schedule 3 of Part 3 of the Constitution, the Scheme of Delegation to [line incomplete]

What are the financial implications to the council of some business refuse to pay the DBID levy? (Cllr Phillips)

The BID legislation prescribes that the same recovery processes that apply to the collection of Business Rates apply to the collection of a BID. The Council however only pays over to the BID company monies that it has collected and there should therefore be no financial implications for non-payment.

Comments are closed.