SBC: That ‘Unsecured’ £9 Million ‘Loan’

- an “In My View” article by NIGEL WARD examining the security of Scarborough Borough Council’s £9 million “loan” to Benchmark Leisure Ltd to develop the Waterpark.

~~~~~

Background

I refer readers to my recent article “The ‘Leased’ Councillor MALLORY Could Do?” (pub. 07/03/18), covering the explanation provided to Councillor Tony RANDERSON [Lab.] by Councillor Helen MALLORY [Con.] at the SBC Full Council meeting of 8th January 2018, regarding what Councillor MALLORY referred to as the eponymous £9 million “loan” to Benchmark Leisure Ltd and the Council’s freehold ownership of the land where the Alpamare Waterpark has been built.

If I understood Councillor MALLORY correctly, she was reassuring Councillor RANDERSON that it was unnecessary for the Council to have taken a charge on the land because the Council is the freehold owner of the land and would therefore automatically repossess it in the event of Benchmark Leisure Ltd defaulting on the lease due to insolvency.

This makes sense; the Council holds the land in freehold and must surely retain that freehold ownership regardless of whether or not Benchmark Leisure Ltd defaults.

But what of the outstanding £9 million “loan”? How could that be recovered?

Analysis

I am not about to suggest that Councillor MALLORY was being in any way disingenuous when she read out her Report from her i-Pad (though I did find it extraordinary that when Councillor RANDERSON pressed her for clarification, the best she could do was read out a part of her Report again, without offering any further insights at all).

But did Councillor MALLORY write that Report? Does she understand it? Do any of the Councillors understand it? I do not. But I do know that it is a rare event indeed when a Cabinet Portfolio Holder actually writes a Report bearing her/his own signature. (And even rarer that all 49 other Councillors should actually bother to read it – much less challenge it).

What I fail to see is this: How does the Council’s freehold ownership of the land provide any security whatsoever for the Council’s recovery from Benchmark Leisure Ltd of the £9 million “loan”?

In the following paragraphs, readers will presently see why I have repeatedly highlighted the word “loan” in the preceding text.

The 30th June 2016 Accounts of Benchmark Leisure Ltd, with their associated Current Liabilities Note 5, do not disclose any Liability in respect of an outstanding “loan”.

This conflicts with Councillor MALLORY’s representation of the circumstances. She refers to a “loan” repeatedly (though she also refers to protecting the Council’s financial “investment”).

SBC – the body corporate – repeatedly uses the term “loan” in Minutes and Reports.

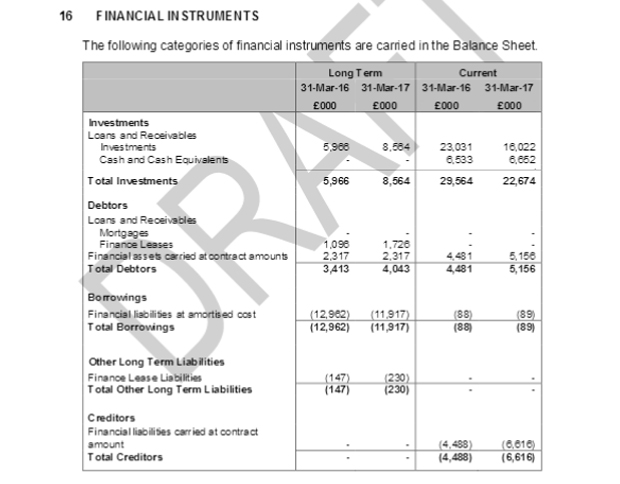

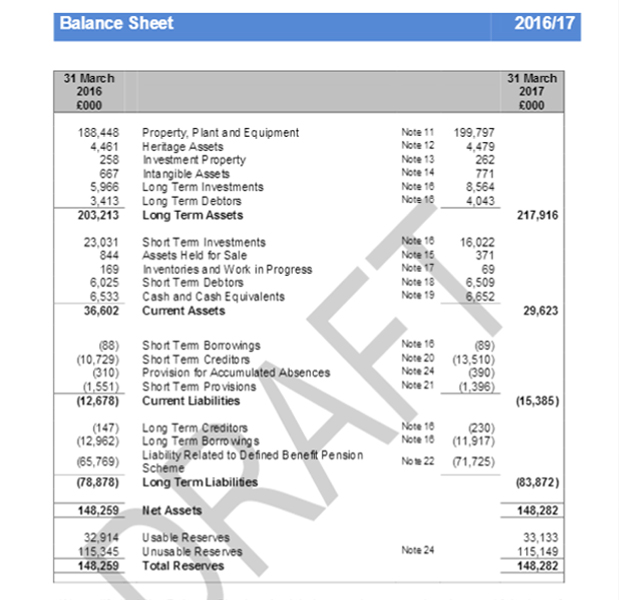

The SBC (draft) Accounts of 31st March 2016 confirm a “loan” to Benchmark Leisure Ltd with an outstanding balance of £5.966 million.

The SBC (draft) Accounts 31st March 2017 confirm the same, with an outstanding balance of £8.564 million (in round terms, the eponymous £9 million).

However, in the Notes to the Accounts (2016, page 115; 2017, page 113), SBC resorts to a different form of words – a long-term “investment”.

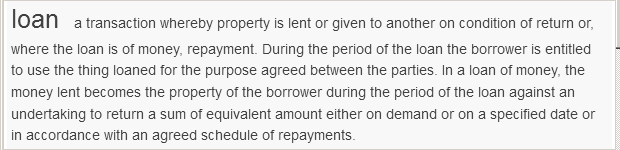

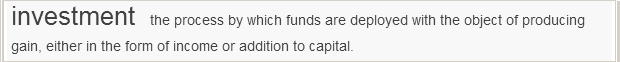

This is passing curious, because a “loan” and an “investment” are two very different types of transaction – so different that they are more-or-less mutually exclusive.

Without wishing to wax too legalistic, I draw reader’s attention to two definitions available on the internet from a free legal dictionary website:

My layman’s understanding of this is best expressed by the following hypothetical scenario:

You wish to start a business, but your available capital will not suffice for you to proceed as far as trading (generating income). You need more capital.

[A] You could ask me for a “loan” (interest rate and repayment schedule to be agreed), in which case, you will be duty-bound to repay me – whether the business succeeds or fails. To be clear, in the event that the business fails, you will still be duty-bound to repay me – though how I may enforce that repayment remains a moot point.

[B] You could invite me to stake an “investment” in your business (profit-sharing to be agreed), in which case, my “investment” undertakes the same risk as yours – namely, the risk of total loss it in the event that the business fails.

[A] offers some (slight) prospect of recovering the “loan”; [B] offers no prospect of recovering the “investment”.

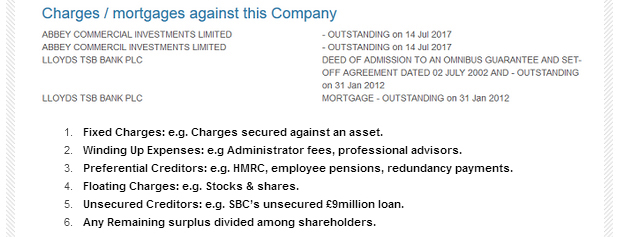

In the case of the Benchmark Leisure Ltd £9 million, surely if the company were to become insolvent, that would mean, by definition, that there were insufficient funds available to repay creditors (including the £9 million that Benchmark Leisure Ltd ‘drew down’ from the Council as a (purported) “loan”, since Benchmark Leisure Ltd has liabilities to other parties which, by way of legal charges, take precedence over any claim raised by SBC.

Yes, SBC would retain the freehold ownership of the land (together with any ground rents), as Councillor Helen MALLORY has rightly stated. But surely the built-asset of the Waterpark (and the lease on the land on which it stands) would inevitably pass to one (or more) other creditor(s)?

For the life of me, I cannot see how SBC could extract ‘blood’ from the ‘stone’ of Benchmark Leisure Ltd’s carcass.

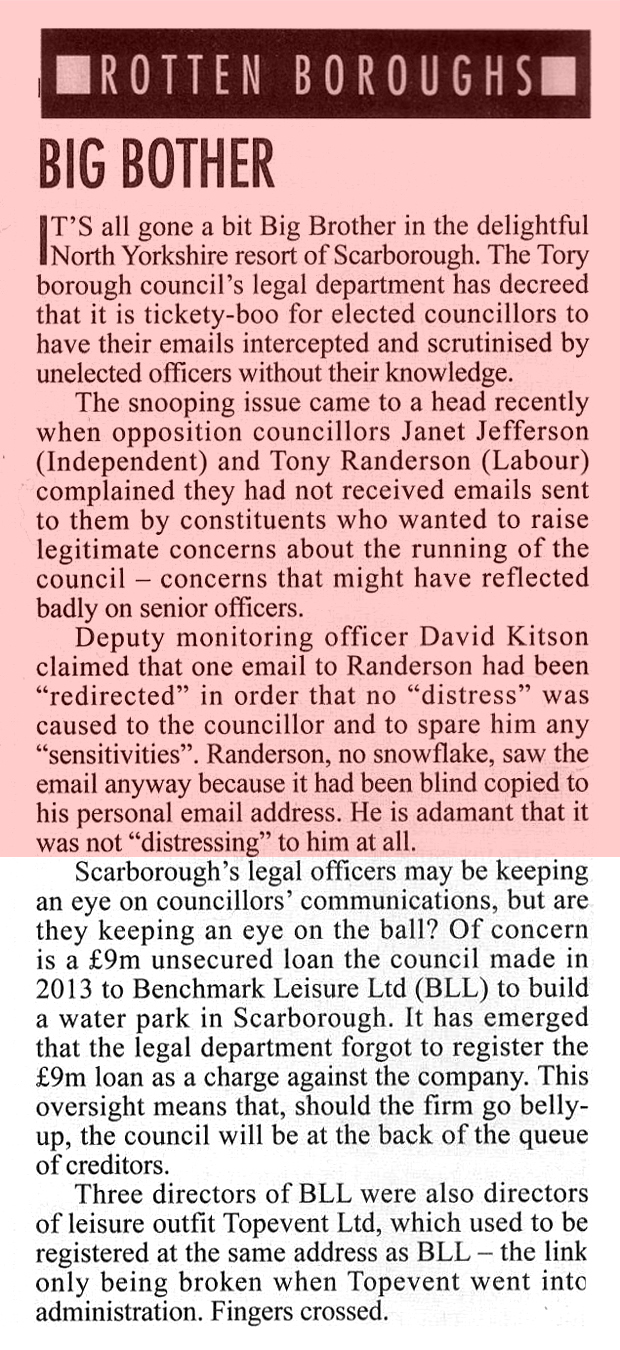

Surely, the £9 million would be lost – all of which is to say that it is indeed unsecured – as NYE editor Tim THORNE pointed out in his article “The Unsecured £9million Loan?” (pub. 06/11/17).

Only those parties who hold legal charges against the built-asset of the Waterpark would stand to see any return.

On the other hand, if the £9 million were not a “loan” but an “investment”, then in the eventuality that Benchmark Leisure Ltd were to capitulate, the entirety of the “investment” would be lost, along with Benchmark Leisure Ltd’s own (or borrowed) “investment” in the development – though some of this would also stand to be acquired by the parties listed above. Considering the Waterpark’s disappointing trading figures, its extended closure and the rumours circulating since before the turn of the year, it is difficult to hold out much optimisim regarding the future of the Waterpark.

Have any Councillors studied the 27-page legal charge held against all of Benchmark Leisure Ltd’s assets by its holding company, Abbey Commercial Investments Ltd?

So is the Council’s (i.e. the public’s) £9 million “secured” or not?

The Portfolio Holder for Corporate Investment seems to have been persuaded that it is.

Would any of the other Councillors care to venture an opinion?

We already know that Private Eye does not think so (see from fourth paragraph onwards):

Comments are closed.