Adult Social Care Council Tax Billing Clarified

- an “In My View” article by NIGEL WARD, interpreting the confusion underlying the misrepresentation of the Adult Social Care precept.

~~~~~

NYCC/SBC

Following Tim THORNE’s widely-read article covering an apparent ‘error’ in this year’s NYCC/SBC Council Tax Billing, and a similar report by Councillor Andy STRANGEWAY [Ind.] covering an identical issue at East Riding of Yorkshire Council, I have been deluged with enquiries and requests to explain what has happened.

I have heard a number of explanations as to why the Billing is correct – and several more as to why it is not.

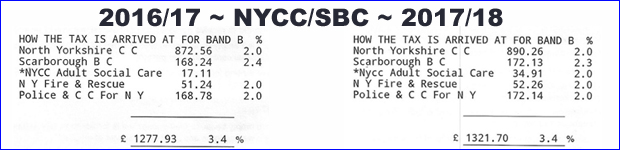

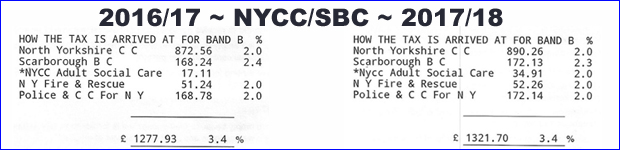

Let us take a look at TT’s 2016/17 Bill alongside his 2017/18 Bill. In each case, the percentage increase over the previous year’s figure is shown in the right-hand column, beneath the “%” sign.

Thus, the £872.56 charge on the 2016/17 Bill for the precept for North Yorkshire County Council represented a 2.0% increase over the previous Billing year.

Moving across to the 2017/18 Bill, we see that the new charge is £890.26 and the stated percentage increase over the 2016/17 figure is correct – 2.0% (to one decimal place).

The same can be said for the Scarborough Borough Council precept: the 2016/17 charge of £168.24 has increased, in 20178/18, to £172.13, with the stated increase correctly recorded as 2.3%.

I will skip, for the moment, the *NYCC Adult Social Care precept, and return to it in a moment.

The charge for the North Yorkshire Fire & Rescue precept – £51.24 in 2016/17 – has increased to £52.26, which is also correctly stated to be an increase of 2.0%.

And, finally, the charge for the North Yorkshire Police and Police & Crime Commissioner precept – £168.72 – has increased to £172.14, again correctly stated to be 2.0%

Returning now to the *NYCC Adult Social Care, it is important to note that this precept was introduced for the first time in 2016/17. This is why the %-column is left blank – there can be no percentage increase on the previous year because in the previous year, there was no separate precept for Adult Social Care.

Nevertheless, for the purposes of completing our inspection, we note that the charge for the *NYCC Adult Social Care precept was £17.11, and for 2017/18, it has increased to £34.91.

Here, an apparent error jumps out of the page. If the increase really was the 2.0% stated on the Bill, surely that charge should read £17.45 (a 2% increase over £17.11 in 2016/17)?

Obviously, an increase from £17.11 in 2016/17 to £34.91 would equate to an increase of 104.0%, would it not? (Remember that services are being savagely cut, but the precept has apparently doubled).

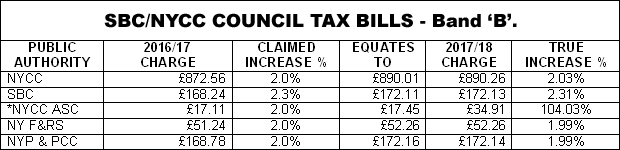

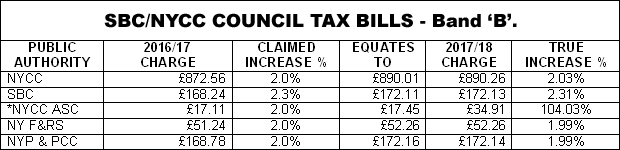

The table below illustrates:

It is important to understand that there is no dispute over the actual charge for the *NYCC Adult Social Care precept. However outraged some people may be at an apparent doubling of this particular precept, it is important to remember that it has been arrived at by due process, and ratified by the relevant elected members of North Yorkshire County Council. It is what it is.

And let me be clear that I do not for one moment begrudge the doubling of the ASC precept – I applaud it. It is the cuts to services that I oppose.

Central government has all but abandoned its responsibilities to those in need of care services of all kinds – and dumped those responsibilities onto local government authorities, who bear the Duty of Care for the needy.

However – and this is the crux of the matter – the act of representing an apparent increase of over 104% as a modest increase reasonably in line with all of the other four precepts – by stating it to be a mere 2.0% – risks committing a serious misrepresentation. It is also what is known as a “procedural impropriety”, because it stands to mislead Council Taxpayers into not digesting the fact that the charge for the Adult Social Care precept has necessarily doubled.

Some correspondents have suggested that it is an act of fraud – not because the incorrect Bill seeks to extort payment beyond what is lawfully correct, which it does not – but because it clearly confers a political advantage on the ‘ruling’ party by implying that they have acted with commendable frugality in managing to keep the *NYCC ASC precept in line with each of the other four increases (NYCC, SBC, NY F&R and NYP & PPC) to a “tolerable” 2.0 – 2.3%%.

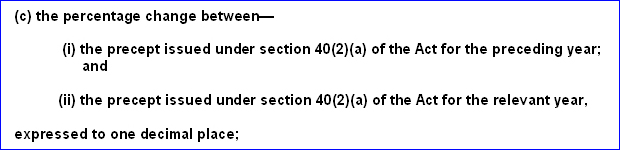

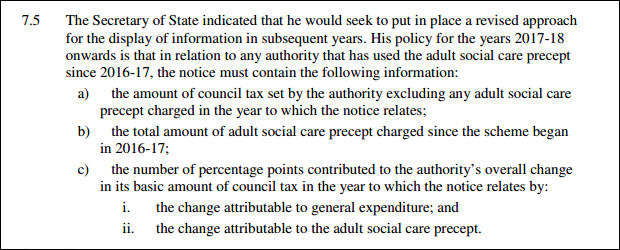

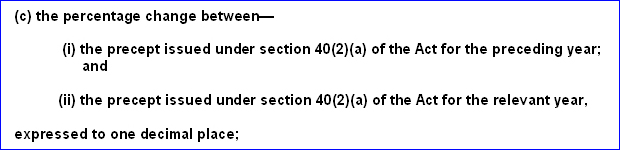

The legislation governing the Billing of the Council Tax has been revised as recently as this year. It is the Council Tax (Demand Notices) (England) (Amendment) Regulations 2017, and the clause which concerns us – s.2(3)(c) – reads as follows:

Clear enough, one would think:

(c) the percentage change between –

(i) last year’s ASC precept (£17.11)

and

(ii) this year’s ASC precept (£34.91),

expressed to one decimal place = 104.0%

Certainly not 2%, as the Bill states.

However . . .

(and it is a big “however”) . . . it turns out not to be quite as simple as that . . .

ERYC

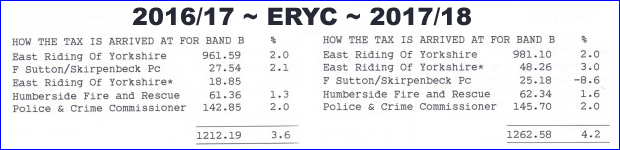

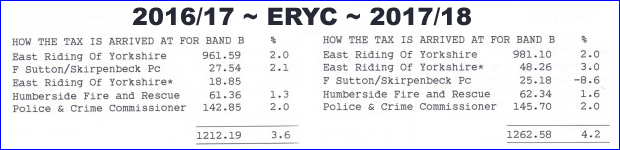

As mentioned in my opening paragraph, ERYC’s Councillor Andy STRANGEWAY [Ind.] has been pursuing this same topic with his own Council.

What is particularly interesting is that East Riding of Yorkshire Council (another bastion of Toryism) has represented its Adult Social Care precept (shown as East Riding Of Yorkshire*) increase in just the same way, with an apparent rise from £18.85 in 2016/2017 to £48.26 in 2017/18, ostensibly presented as an increase of only 3.0%, when in fact it would represent an increase of 156%.

And note, too, that the five individual precepts are even presented in a different order this year, presumably to frustrate comparison.

Again, I am not for one moment begrudging the very necessary increase in the ERYC* Adult Social Care precept. It is the informational misrepresentation that causes concern.

But it is also interesting to note that ERYC Director of Corporate Resources (and in-coming Chief Executive) Caroline LACEY, has stated:

- “We are currently preparing information to be added to the Council’s website to help billpayers to understand how the increases are calculated and presented on their bills.”

In many people’s view, this response falls a long way short of setting matters to rights; not every Council Taxpayer will feel the need to visit the Council’s website and many will remain unaware of the apparent ‘error’. Some will feel the need to visit the Council’s web-site and I will be returning to that presently.

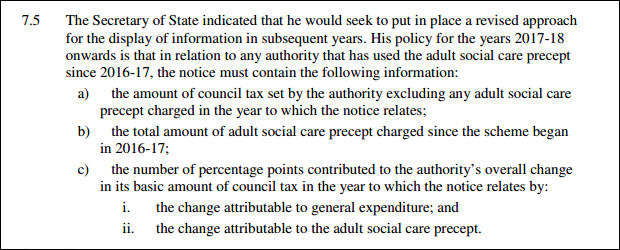

Meanwhile, Caroline LACEY has kindly provided Councillor STRANGEWAY with further documentation (forests are destroyed documenting local government legislation) which, on the face of it, sets the whole business in order.

She refers to an Explanatory Memorandum published alongside the 2017 legislation, the relevant passage of which reads:

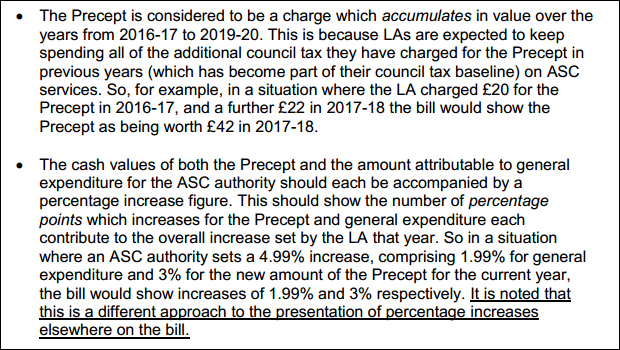

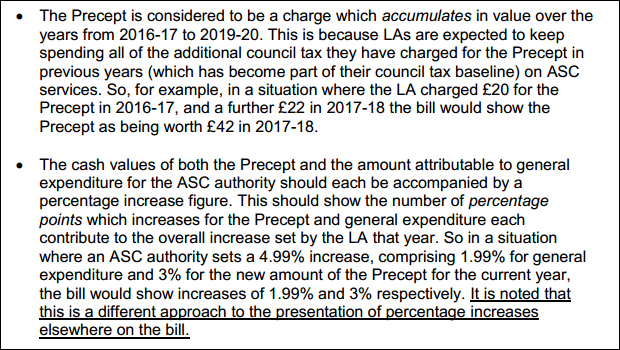

There followed a Q&A document to further assist Council Officers in making sense of the matter:

Briefly, the ASC precept is calculated as having accumulated since its inaugural appearance in 2016/17, this year’s figure, as shown on the Bill, is the total for this and last year (2017/18 plus 2016/17) added together. In regard to the underlined passage (the last sentence of the lower bullet-point), one can only say, “No shit, Sherlock!”. It certainly is a different approach – and Council Taxpayers are entitled to be given a full explanation of that difference.

So now we arrive at the principle problem:

- How is Joe Public, on receiving his Council Tax Bill, supposed to understand what she/he is paying for Adult Social Care and how it compares with 2016/17?

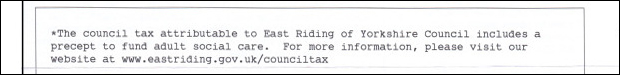

The fact that the Adult Social Care precept is a special case – its pecularities defined in the bowels of a Statutory Instrument accompanied by an Explanatory Memorandum (which itself requires a specially prepared Q&A document) – is indicated on the Bill by an asterisk (*), so that poor old Joe Public can easily get to grips with what is so special about this Item on the Bill. A little further down the Bill, one finds (sure enough) an explanatory note:

And at this point, poor old Joe finds himself up a blind alley, because that URL-link returns:

Fortunately, there is a page on the ERYC site that does give access to Council Tax information:

Unfortunately, nothing on this web-page even begins to explain the Adult Social Care information provided by Caroline LACEY – so Joe Public still has no possible way of understanding his Bill.

Even worse, the NYCC/SBC version of the Council Tax Bill also marks Adult Social Care with an asterisk (*), and further down the page on the NYCC/SBC Council Tax Bill we find:

- *The council tax attributable to North Yorkshire CC includes a precept to fund adult social care

Wait a minute. If “the council tax attributable to North Yorkshire CC includes a precept to fund social care”, why is *NYCC Adult Social Care listed separately on the Bill? Is it included or not?

Joe Public might be able to find out this information, if only there was a web URL-link indicated on the NYCC/SBC Bill so she/he could visit the SBC web-site and find out more – or at least something. Alas, there is no URL-link. And still no response to the Enquirer request for information from Nick EDWARDS, Councillor Helen MALLORY and Lisa DIXON.

So, in fact, neither ERYC nor NYCC/SBC has published – even in the sloppiest sense – any explanation whatsoever of the scant information provided on their respective Council Tax Bills. This is a “procedural impropriety” big-style – and in breach of legislation.

Conclusion

For all that both Councils’ Council Tax Bills do contain “procedural improprieties”, I would not expect this to prevent the respective Councils from pursuing enforcement for non-payment. And certainly, if one wished to resist paying one’s Council Tax, there are far more compelling reasons for wishing to do so. (I have reported elsewhere on the astonishing way in which Councils issue mass-produced home-made ‘Court Summonses’ and ‘Liability Orders’ as a prelude to rolling out the Bailiffs. It is a national disgrace).

So this particular cock-up will be added to a lengthening list of ineptitudes that is bound to increase – and, in all probability, at a rate of 104% over the next twelve months in Scarborough and/or 156% in Beverley. [Memo to Self: I must stop succumbing to the temptation to sarcasm – it is probably classed as harassment these days].

The correct way forward would be for both Councils to send letters of apology to all Council Taxpayers, enclosing a correct and satisfactorily explained Bill.

Of course, that costs face. And it costs money.

On the plus side (for the Councils), the customarily unaccountable Council Legal Officers who commit such blunders will try to blame the Enquirer (and Councillor Andy STRANGEWAY) for wasting public resources. (And still there are fools out there who think we should stop criticising and let these cock-ups pass unremarked – so they can happen again and again, year on year. As they have done. As they do).

What we need is more Councillors with the nous and the cojones to hold incompetent Officers to account.

UPDATE

Following publication of the above article (Thursday 23rd march 2017), ERYC Councillor Andy STRANGEWAY [Ind.] has now been able to report that East Riding County Council has today revised its web-site:

~~~~~

Posted on March 24, 2017 by andystrangeway

The Council Tax information which regulations state ERYC must share with residents has finally been added to their website. Hopefully residents can now make sense of their misleading Council Tax bills.

Please see ERYC Council Tax for full information.

More from the North Yorks Enquirer

Comments are closed.