“YCBID: Dead (and about to lie down?)”

An Open Letter from the Yorkshire Coast Levy Payers’ Association (accompanied by a range of explanatory documents) to members revealing potentially ‘fatal’ flaws in the Levy collection process amounting to alleged misrepresentations, rendering the Levy collection process invalid.

YCBID’s £220K “Survivor” puppet – seen here (above) lying lifeless on Whitby West Beach [insert] on the very day the Final Demand Notices were issued – has brought no discernible increase to tourism footfall. For full coverage of nearly fifty North Yorks Enquirer articles about the Yorkshire Coast BID, follow this link.

Surely, it is time to press the “red button”?

~~~~~

Dear all,

Please, please, please, whatever else you do tonight, take the time to read and absorb the information provided here. It is vital to what we aim to achieve.

It is the result of a huge effort on behalf of someone who is not a member of our group, but will help us all to get this thing done at last.We’ll be forwarding a couple of template letters for you later which you can adapt – this affects EVERYONE whether you have paid or not.

The attached documents have been circulated to all SBC Councillors. These documents are many-edged:

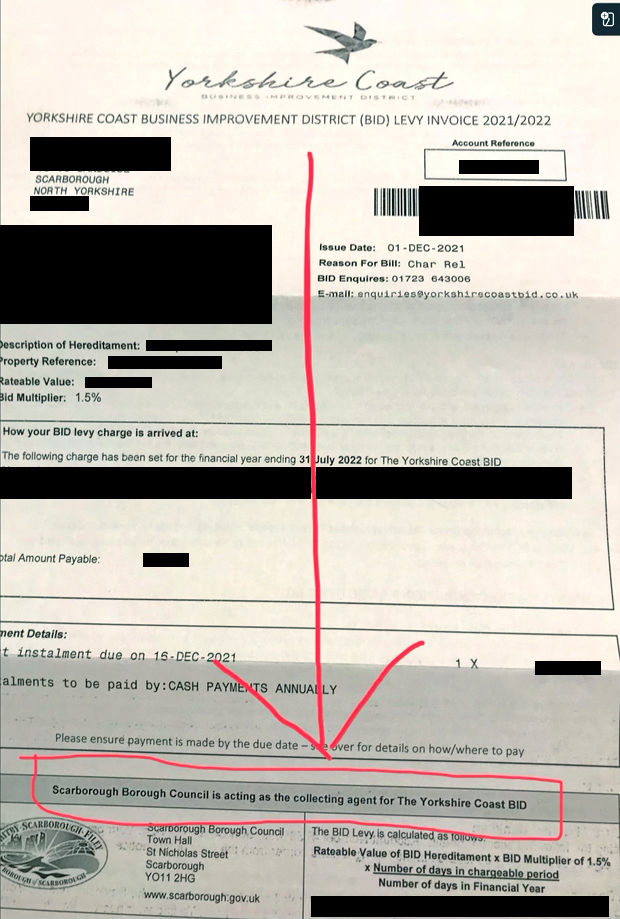

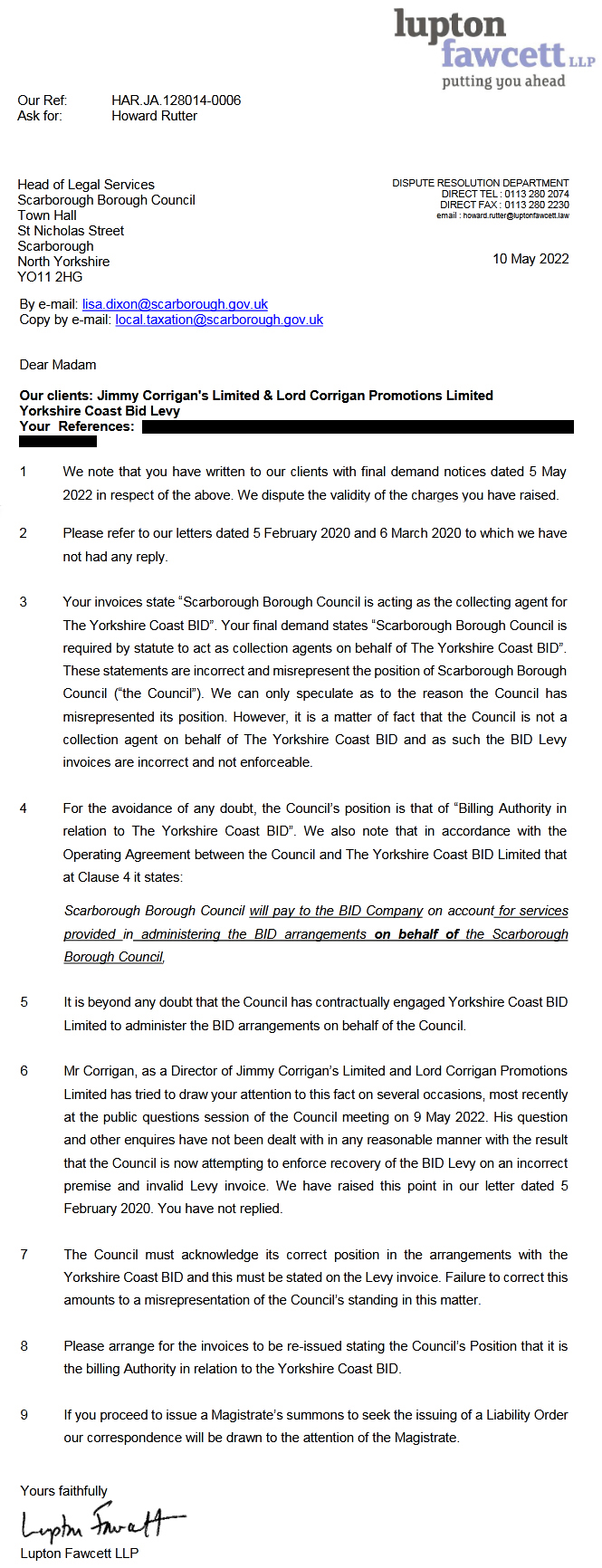

1) They provide a very firm footing for all those who have been invoiced incorrectly by Scarborough for the BID levy. At the bottom of your bill it states that ‘SBC are the collecting ‘agents’ on behalf of Yorkshire Coast BID. Template letters to follow are for you all to adapt and circulate to raise your own challenge.

2) It supports our now very clear position to have the BID terminated under section 18 of the BID regs. Both ERYC and SBC have claimed they are the ‘agents’ and therefore powerless to stop it. They have mislead everyone.

3) Not only, but also – we have documents which prove that The Yorkshire Coast BID Co Ltd are misrepresenting themselves by stating that the local Councils are the agent. We have every reason to believe that this is a very serious matter.

Thank you.

Yorkshire Coast Levy Payers’ Association

DOWNLOAD LINKS

Template One (for those who HAVE NOT PAID their Levy Invoices).

Template Two (for those who HAVE PAID their Levy Invoices)

EMAIL ADDRESSES

To: Lisa.Dixon@scarborough.gov.uk

Cc: Mike.Greene@scarborough.gov.uk

Cc: Nick.Edwards@scarborough.gov.uk

Cc: Richard.Bradley@scarborough.gov.uk

VAT CONSULTANT’S SUMMARY

Scarborough Borough Council (“SBC”) claims it is the “Collecting Agent” for the Yorkshire Coast BID (“the BID”). It states this on its BID Levy invoices and also claims on the Final Notices that it is required to act as the collecting agent by statute.

Why is this wrong?

SBC is the Billing Authority for the BID. This is its Statutory position in The Business Improvement Districts (England) Regulations 2014 (regulation 15 states “The relevant billing authority shall, by the commencement date, provide for the imposition, administration, collection, recovery and application of the BID levy and Schedule 4 shall have effect with respect to those matters.”)

The BID is a separate entity and it is an event organiser to deliver the agreed objectives of the BID.

If SBC was a collecting agent, as it claims, it would pass the levy collected over to the BID without any further requirements. If this was the case, then the BID would not have any VAT-able supplies and would not be eligible to be VAT-registered, meaning it could not reclaim VAT on all the events it organises.

However, that doesn’t happen. The BID is VAT-registered and sends a VAT Invoice to SBC for the levy collected plus VAT.

SBC has a contractual agreement with the BID (“the Operating Agreement”). Under this agreement, SBC has contracted with the BID to administer the BID arrangements on behalf of SBC.

What does this actually mean?

The BID charges SBC for delivering the BID objectives (the events and other activities it has planned).

Why is this important?

Because the BID can then register for VAT with HMRC and charge VAT on the services it carries out for SBC (these services are anything and everything to to do with delivering the BID). SBC pays the levy income plus VAT to the BID. SBC claims the VAT back under the normal procedures, so there is no additional cost to the Council.

The BID pays the VAT over to HMRC, but the important point is that because the BID is VAT-registered, it can reclaim the VAT it incurs on its costs.

If it was not VAT-registered, the BIDs costs would be increased by 20%! The VAT treatment is extremely important to make the operation of the BID efficient. If the Council was the collecting agent, as it claims, then the BID company would be unable to be VAT-registered and could not then claim the VAT back on its costs.

This VAT treatment is endorsed by HMRC in its published Manual, here.

Solicitor’s Letter to SBC (10/05/22)

EMAIL TO SBC LEADER CLLR STEVE SIDDONS (13/05/22)

EMAIL TO SBC LEADER CLLR STEVE SIDDONS (15/05/22)

Date: 15 May 2022 at 20:04:58 BST

To: “Cllr.Steve Siddons” <Cllr.Steve.Siddons@scarborough.gov.uk>

Cc: All Councillors

Subject: FULL COUNCIL 9th MAY-PUBLIC QUESTION-DBID

Members

Thank you for your numerous communications with me. Feel free to call me on my mobile if that is more convenient [REDACTED].

The 2 main areas of your questions and comments arise from:

1. Understandability – difficulty understanding the VAT issue, it’s relevance to this and how and why does this demonstrates the legal position, and

2. That officers must be aware of SBCs position as the Principal.

For assistance I have had an explanatory document (a single page) produced (see above) to explain in lay terms your position in relation to the BID

As for the second query I have links to contemporaneous agendas, news articles and documents that demonstrates that this is absolutely the case. If it wasn’t the VAT treatment internally wouldn’t have been administered in accordance with HMRC’s stated policy set out in their manual extract as an attachment to an earlier e-mail in this thread.

I have also included a link to my FOI request that has been refused to be dealt with on the grounds of commercial sensitivity. Please use your own judgment on whether this is a fair use of the exemption.

I have also included some suggested questions on the attached Notes that will assist further in demonstrating the Council’s position.

As members you have an absolute right to answers to these questions which I suggest you make in writing and also to seek the documentation relating to my rejected FOI, the invoices between YCB Ltd and SBC.

You may recall Mr Stanyon criticised the legislation that governed the BIDs establishment process and some of the Council’s procedures, but he concluded that the process overall was lawful. You will recall that in the Stanyon report there were many learning recommendations made to the Council and some unresolved issues. However, he did not look at any of the Council processes once the BID had been established. It appears to me that the Council has not understood its legal position fully once the BID had come into existence, as it claims to be the collecting Agent for the Yorkshire Coast BID. I should add that the Yorkshire Coast BID Limited also refers to the Council as its “collecting agent” which of course continues to promote this misrepresentation of the Council’s position.

To Members who think that your officers stated position is correct and that I am incorrect, and have been for 3 years, please have the courtesy of considering the evidence below and that sent earlier. I will welcome any explanation to confirm how your officer’s stated position can possibly be the case.

I look forward very much to being able to work with the incoming Unitary Authority Members (and officers) who have expressed great interest in the DBID administration when they take up their ‘Shadowing role’

Kind regards

James Corrigan

~~~~~

Supporting documents and links

Evidence and links to documents on the Council Website, the Yorkshire Coast BID website and Scarborough News:

This is the Cabinet Member Decision that was taken on 31 July 2019 to enter into the Operating Agreement. Note the Operating Agreement is included at Appendix 1. Look at section 4 on the bottom of page 5 which explains how the BID Company is providing services to the Council. Also note NE Report 19/164 confirms the agreement had been reviewed by the Legal Department. The explanation about the need for the Urgent decision is interesting on the printed decision notice explaining delays in getting the document reviewed and back from the BID Company. This hardly set the scene for a good working relationship!

This is the feasibility report prepared by the consultant Mosaic. Look at the bottom of page 23 under the heading “Operating Agreement”. This has some explanation about the agreed VAT treatment between Mosaic and HMRC. I included the specific HRMC document Mosaic refers to in this link to yourselves previously.

Please see the Freedom of Information Request correspondence below. Why has SBC refused to supply this simple and straightforward information – Is it really commercially sensitive?

Please look back at the Minutes for the Cabinet meeting of 21 July 2020 see Agenda item 10 for the discussion about the BID.

It is clear that members wanted to find a mechanism to terminate the BID.

There is also the Scarborough News report of this meeting below:

The following is a link to the report of Peter Stanyon, who investigated the process of holding the ballot.

Comments are closed.