SBC’s YCBID VAT Defence WRECKED!

- – an “In My View” article by NIGEL WARD, offering the briefest of introduction to conclusive evidence of a famous victory.

~~~~~

The Enquirer has been covering the dispute over SBC’s treatment of VAT in relation to YCBID invoices for quite some time now (sometimes in a taunting manner) – but not, it seems, for as long as Scarborough businessman Mr James CORRIGAN.

Mr CORRIGAN first raised the Council’s misinterpretation of the VAT regulations with Senior Officers as long ago as November/December 2019. Not only did those Senior Officers ignore Mr CORRIGAN’s helpful advice, they also ignored Mr CORRIGAN’s solicitor, LUPTON FAWCETT LLP.

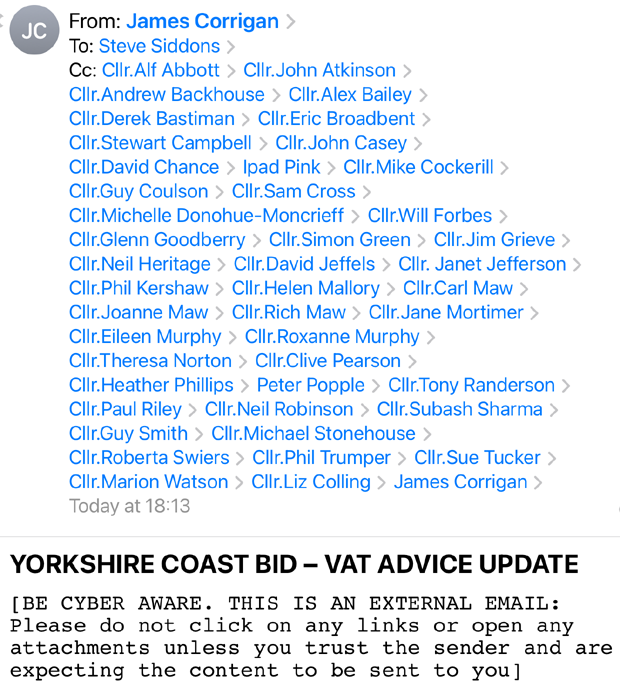

I leave it to Mr CORRIGAN to explain the technicalities, as he has done in the following email to the Leader, Councillor Steve SIDDONS [Lab.], and all Councillors (but no Officers). I have taken the liberty of correcting one spelling error* – the only error I could find.

The consequences of this email really should be self-evident.

Dear Councillors

YORKSHIRE COAST BID – VAT ADVICE UPDATE

I feel it is important that I write to you to provide an update about the VAT Administration by the Council in relation to the Yorkshire Coast BID.

I’m sure that you will all recall that I raised an issue that the Council was not administering the BID correctly. On 30 September 2022 KPMG LLP issued a VAT invoice to the Council for £5,000 + VAT. On seeing this payment in the monthly published list of payments I submitted a freedom of information request to the Council to request details regarding this payment. The full history of the FOI request can be viewed here:

https://www.whatdotheyknow.com/request/yorkshire_coast_bid_vat_advice#incoming-2219277

Whilst it is not surprising that the Council has refused to provide the Report from KPMG, on the basis that its disclosure would ‘prejudice the effective conduct of public affairs’, the Council has disclosed the nature of the advice it sought. This is in the form of a detailed schedule titled ‘Scope of Works’ attached to the formal letter of engagement. I have attached a copy for ease of reference.

UNFORTUNATELY THE COUNCIL DID NOT ASK THE CORRECT QUESTION.

The Scope of Works describes an ‘Understanding of the Facts’ which is the basis of the KPMG work. Unfortunately, this ‘Understanding of the Facts’, is in essence a summary of how the relationship with YCBID is SUPPOSED TO WORK. My specialist advisers produced a ‘Briefing Note’, which I shared with some SBC Councillors. The document was leaked to the North Yorkshire Enquirer who then sought my consent to publish it. The article appeared on 1 July 2022 – it can be found here

http://nyenquirer.uk/plea-4-fair-vote/

The Briefing Note set out how the BID was supposed to work, which is very similar to the stated ‘Understanding of the Facts’ on the KPMG Scope of Work. However, the Briefing Note also went on to explain the reason for the VAT problem. It appears that those issues have not been considered by KPMG as they were not referred to in the ‘Scope of Work’.

I should also emphasise that I first wrote privately, through my lawyers, to the Council in the autumn of 2019 setting out these points, but for whatever reason my lawyers correspondence was not substantively dealt with. My position as been consistent subsequently.

Just as a further piece of simple, but damning evidence, look at the attached FOI [see below] which refers to the narrative on the invoices (I have copies of all the invoices which I examined as part of the accounts inspection process. I can confirm that the narrative on the actual invoices is as stated in the FOI reply). The Invoices, which purport to be VAT Invoices, do not meet the requirements set out by HM Revenue & Customs as they do not describe the services supplied to the Council. The Invoices are raised for ‘Collections draw down as of 29.8.2021’ or similar.

There can be no doubt that these invoices do not meet the requirements of a valid VAT Invoice, because there is no description of the Services supplied. KPMG were not asked that question! It follows that if the invoices are not valid the VAT cannot be recovered.

According to the KPMG ‘Scope of Works’ [see below] Item 2 of the advice sought states ‘[whether] The Council is correct to recover VAT on the services that it receives from BIDCo.’

This question 2 pre-supposes that the Council is receiving services from Yorkshire Coast BID Ltd and has not even considered the validity of the VAT Invoice that is used to support the recovery of VAT.

I would also like to draw your attention to the extract below from the Minutes of full Council on 9 May 2022:

Mr James Corrigan

Q: In relation to the statement from the Portfolio Holder for Corporate Resources, Cllr Jefferson, she states that the Council will start recovery proceedings in relation to the outstanding BID Levy amounts.

Please confirm what (if anything) the Council purchases from Yorkshire Coast BID Limited, UK Company number 11820859.

R: Thank you for your question

The arrangements with the Yorkshire Coast BID Ltd cannot be described as a simple purchasing transaction.

The Council makes payments to the Yorkshire Coast BID Company in accordance with the contractual arrangements set out in the Operating Agreement. A copy of the operating agreement is available on both the Council and Yorkshire Coast BID’s websites.

Details of Council spend above £500 is also available on the Council’s website.

In conclusion, whilst the Council has refused to disclose the KPMG report, it is of no value because this specialist firm was not asked the right question. Another waste of £5,000 of our residents’ funds, when we are told that the Council resources are very limited.

I am sure that you are all aware the Leader of the Council is a member of the Chartered Institute of Public Finance and Accountancy, the same body that Mr Edwards and no doubt others in the finance team are members of. They are all qualified accountants – surely they must have their own view on this. I urge you to raise this with them.

Put simply and consistently there can now be no doubt that SBC is the PRINCIPAL* and YCBID is the Council’s AGENT.

I look forward to my day in Court when all of these questions can be put to those charged with Governance at the Council (assuming they are still there).

Yours sincerely

James Corrigan

Scope of Works document

FOIA 8486 Review Response

Briefing Note (1st July 2022)

BRIEFING NOTE

THE BID

This is a brief note to explain how the BID is supposed to operate and the VAT implications. It then considers what appears to have gone wrong with the Yorkshire Coast BID. This note does not consider the establishment of a BID, just the operation of it once in existence.

How it is supposed to work

1. The Council (SBC and ERYC) is the “Billing Authority”. As such the Council issues Levy invoices to the businesses and has a legal right collect the Levy. VAT is not allowed to be charged on the Levy. It is in effect a tax similar to National Non Domestic Business Rates. Note that the Council is not an ‘Agent for the BID Company’.

2. The Council must pay the Levy collected into a special account called “the BID Revenue Account”. The legislation prescribes what can be taken out of the BID Revenue Account. Essentially, that is:

a. The costs of collection;

b. Refunds of Levy overcharged;

c. The costs of delivering the BID objectives/proposals (i.e. those things that are to Improve the Business in the BID Area).

3. Whilst the Council can contract with separate entities to provide the BID objectives, it is more common to contract with a BID Company – in this case, Yorkshire Coast BID Limited. The arrangement between the Council and the BID Company is set out in an Operating Agreement.

4. The Operating Agreement provides that the BID Company will charge the Council a fee for “administering the BID arrangements”. i.e. the BID Company is an ‘Event Organiser’ that delivers all the objectives in the BID proposal on behalf of the Council. Because the BID Company is delivering a service to the Council, this requires the BID Company to be VAT-registered if the turnover exceeds the registration threshold. This is beneficial because:

a. It enables the BID Company to recover the VAT it incurs on its costs. e.g. say the BID Company undertakes a marketing campaign with an advertising company, the advertising company would charge VAT on the cost and the BID Company could then reclaim it; and

b. From the Council’s point of view, the VAT charged by the BID Company can be reclaimed from HMRC in the normal way Council’s recover VAT. There is, therefore, no detriment to the Council, other than the administration.

5. The level of the fee that the BID Company charges the Council is defined in the Operating Agreement as the Levy Collected each month after deduction of the collection costs and refunds. Note from 2, above, it is clear that the costs of collection and refunds can be deducted from the BID Revenue Account. It is therefore clear that the BID Company does not get charged for any collection costs as the fee it charges is an amount after the collection costs have been deducted. Similarly, the BID Company does not have BID Levy as its income or turnover. The BID Company’s income is the fee it charges the Council for administering the BID.

What has happened with the Yorkshire Coast BID Limited?

1. SBC and ERYC appear to have acted as ‘Agent’ for YCBID. There are several factors in coming to this conclusion:

a. The Levy invoices state that SBC is the Collecting Agent for YCBID.

b. SBC Head of Legal Services has confirmed in writing that SBC is Agent for YCBID.

c. We have been told, in an FOI from SBC, that the invoices raised by YCBID to SBC show a narrative of “Levy Collections for Month”, or similar.

d. The Published Accounts for YCBID disclose that its turnover is “… the fair value of levy charges raised on businesses within the BID area…”. This indicates that YCBID believes it is receiving the Levy – not providing a service to SBC and YCBID.

e. We have also seen the detailed accounts for YCBID, which disclose in its Cost of Sales the Levy Collection Costs. We have seen this also in the Lincolnshire Coastal BID Accounts. The costs of collection are not an expense of the BID Company. Look at 5 above. As the Council thinks it is an “Agent”, it charges the BID Company a fee for collecting the Levy. This is what an Agent does.

f. We know SBC is not deducting the BID Levy collection costs from the BID Revenue Account as this has been disclosed in an FOI.

g. We believe ERYC is acting in the same way, otherwise YCBID would identify that each Council was operating in a different manner.

h. As both parties to this arrangement (each respective Council and YCBID) have acted in a manner that is consistent with the Council being an Agent they have, by their deliberate and continued conduct, demonstrated an agreed variation to the Operating Agreement. That is, that the Council (SBC and ERYC) is acting as an Agent for YCBID.

2. It is a clear principle that if the Council collects the Levy as Agent for YCBID, then the Levy is automatically belonging to YCBID. This means that YCBID does not provide a service to the Council and is not therefore eligible to be VAT-registered.

3. If YCBID is VAT-registered in error, then the invoices it has issued to SBC and ERYC, charging VAT, have been raised in error and are invalid. SBC and ERYC have reclaimed this VAT from HMRC. If it shouldn’t have been charged, then it will have to be repaid to HMRC. Of course, will SBC and ERYC be able to recover this from YCBID?

How should this be rectified?

1. The Council and YCBID have to admit they have administered this incorrectly.

2. YCBID has to correct the invoices it has raised to SBC and ERYC for the correct amounts (i.e. the Levy collected less the collection costs) and the correct narrative (i.e. “administering the BID arrangements”);

3. SBC and ERYC have to cancel the VAT Invoices raised to YCBID for the collection costs.

4. YCBID has to re-state its accounts. This could be done by way of a prior period adjustment, or a complete revision of the accounts on the basis they are defective. I would prefer the revision of the defective accounts as the error is so fundamental.

If the above is not done, the alternative is to maintain the present position, but contact HMRC to confirm that YCBID should not be VAT-registered. This will then have the consequence that SBC and ERYC will have to repay the VAT claimed and seek its recovery from YCBID. It is unlikely that this option would be adopted because of the very substantial amounts that would be required to be repaid to HMRC.

East Riding of Yorkshire Council, take note.

I wrote to East Riding of Yorkshire CEO, Mrs Caroline LACEY, in August 2022. She did not respond. Some people you just cannot help.

——– Original Message ——–

Subject: YCBID – Cllr J EVISON

Date: Thu, 11 Aug 2022 13:32:41 +0100

From: Nigel Ward

To: Caroline Lacey <caroline.lacey@eastriding.gov.uk>

Mrs Caroline LACEY – CEO & HoPS – East Riding of Yorkshire Council

IN THE PUBLIC INTEREST

Caroline,

Good day to you. I hope you are in good health?

As ever, I write to you in a spirit of helpfulness and co-operation.

I would imagine that you are already aware that, following Resolutions at both ERYC and SBC (the ‘lead’ authority), there have been repercussions with regard to the two Councils’ unfortunate involvement in the affairs of Yorkshire Coast BID Ltd. which is having such a negative impact on your Council’s good standing in the public perception.

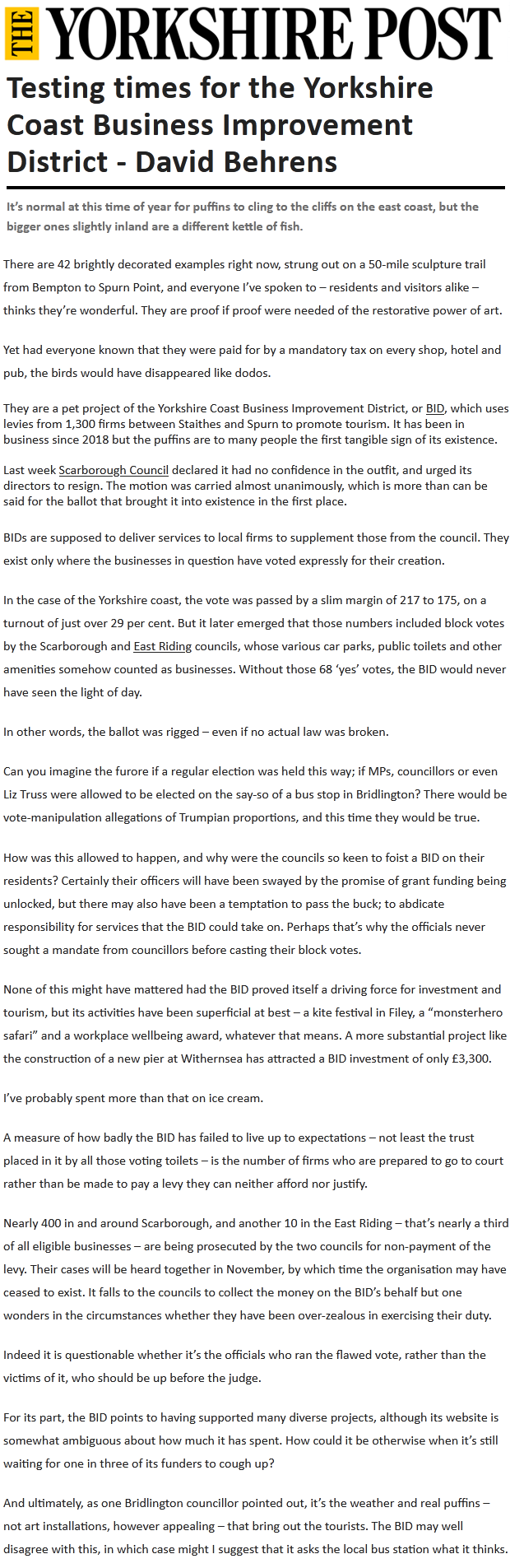

I draw to your attention David BEHRENS’ Yorkshire Post article from Sunday 7th August 2022. Please see attached. [see below]

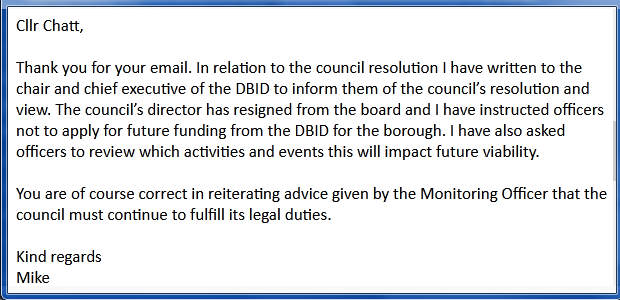

I hope you are also aware that SBC CEO & HoPS, Mr Mike GREENE, has taken action to distance his Council from a private limited company in which members have expressed, on Thursday 29th July 2022, NO CONFIDENCE in its governance arrangements [see below]. SBC delegate Mr Richard BRADLEY has apparently already resigned from the BID Board. Please see attached. [see below]

Clearly, it would be highly inappropriate, in these circumstances, for ERYC to continue to provide a delegate – namely, Councillor Jane EVISON [Con.] – to the BID company’s Board of Directors, or to continue providing logistical support of any kind.

Further, the location of 1.5m ‘puffins’ on Council land, some without Planning consent (and in some cases, in Conservation Areas), and other similar ‘concessions’ must surely cease forthwith.

I hope you will be able to confirm for me, ideally before close-of-play tomorrow (Friday 12th August 2022), that you have taken the necessary steps to distance the Council from further embarrassment and potential legal action – particularly as the present VAT arrangements are, on the highest authority, entirely indefensible.

Yours, with kindest regards,

Nigel

Comments are closed.