Potto: Where’s the Money [Pt 2]

- – an “In My View” article by NIGEL WARD, presenting Part 2 of an article about the financial affairs of Potto Parish Council, examining the opacity around the Councils financial performance, and begging the question: “Is this merely guileless incompetence – or something far more reprehensible?”

~~~~~

The Public Interest Report (PIR) issued on 21st July 2022 by Potto Parish Council’s External Auditor, PKF LITTLEJOHN LLP, concerns itself with the Council’s returns for 2017/18, 2018/19, 2019/20 and 2020/21. This has burdened the taxpayers of Potto with a debt of £37,102.00 – and that is on top of two previous Investigations (for 2015/16 and 2016/17) charged, respectively, at £5,365.12 and £4,703.87 – making a grand total of £47,170.99 in Investigation fees which should never have arisen.

Of course, given the continued wayward and utterly unrepentant conduct of the Council, the 2022/23 Annual Accounts are virtually certain to attract further Objections, with the risk of concomitant Investigation charges, at a cost that is (as yet) impossible to estimate.

Considering the Annual Account for 2021/22, one transaction, in particular, leaps off the page. Astonishingly for a tiny Parish Council with a Precept income of a mere £7.1K (for 2021/22), there has been an UNBUDGETED single-item expenditure of over ten thousand pounds – over 145% of the actual Budget (recorded as follows):

No reference to the £10+K now under scrutiny.

The total planned expenditure on everything for 2021/22 is shown as just £7,100.

How is it, then, that I find this little gem squirrelled away in the Annual Accounts?

![]()

This £10,180.80 ‘Footpaths Maintenance’ (note the plural) expenditure is a false entry, since not only does it not appear anywhere in the Budget (as all items of expenditure MUST, by law) but, as I have since discovered, it refers to a single ‘bridleway’.

Wild over-expenditure on this scale can only ever be justifiable under conditions of catastrophic emergency – curiously, unmentioned in Council Minutes.

In fact, this ‘Footpaths Maintenance’ work is barely mentioned in meeting Minutes at all.

However, the May 2021 Minutes, do record, at Item 5.3:

Interestingly, the Agenda for this meeting did not include even a hint of a proposal for this work; it did not include any applicable documentation (e.g. Tender invitations, quotes, estimates, site surveys, etc.), nor did it anywhere allude to a ‘bridleway’. In fact, the Council’s so-called ‘Agreement’ was a breach of Schedule12. Part II. Section10 (2)(a)(b) of the Local Government Act 1972 and therefore UNLAWFUL because the business transacted was not properly published on an Agenda.

But then Item 3 of the August 2021 Minutes states:

So only one quote from a single contractor was discussed. I can locate no other reference to any other quote or any kind of legitimate Tender process, as is required to ensure best ‘value-for-money’ in accordance with Article 9 section 3 of the Council’s Financial Regulations, below:

Nor can I locate any Resolution of Council according delegated powers to Councillor Ian MACPHERSON as sole representative of the Council in this matter – a flagrant breach of Article 26 of the Council’s Standing Orders, which state:

Notwithstanding, it seems that Councillor MACPHERSON did inspect land (i.e. the ‘bridleway’) and did issue orders and instructions to the contractor, none of which were discussed, recorded, agreed or ratified by full Council.

This, as well as the formal approval of the expenditure, is confirmed in the September 2021 Minutes, which state, at Item 4.3:

These financial restrictions were ignored and breached – especially in regard to s.137 of the Local Government Act 1972 (LGA72) – see below.

Furthermore, there is no record whatsoever in the Minutes regarding Councillor MACPHERSON’s negotiations with the contractor.

I also note that whilst s.43 of the Highways Act 1980 can permit a Parish Council to maintain a bridleway, it also states, at s.43(3) that:

- “The power of a parish or community council under subsection (1) above is subject to the restrictions for the time being imposed by any enactment on their expenditure”.

I note, too, that neither the August nor September meeting Agendas included the ‘bridleway’ as a topic or proposal. Even the word ‘bridleway’ is conspicuous by its absence. So the ‘agreement in principle’ was always unlawful – though this is seemingly a sine qua non of Potto Parish Council’s methods, at least in my experience.

Furthermore, there is no record of any kind regarding the alleged meeting with the contractor. The entire transaction was out-of-control and shrouded in secrecy.

Nevertheless, it seems that the Council believes that some work may have been carried out and the Council subsequently ‘agreed’ to pay the Coxon Brothers’ invoice.

Though there was no meeting in October 2021, the November 2021 Minutes state:

Unfortunately, I can find no record that the Council, either collectively or through the individual actions of Councillor MACPHERSON, has ever ascertained that any of the work was carried out, or the degree to which the scope and quality of any such work was acceptable, or whether or not any guarantee or indemnity was secured. You pays your money (your electors’ money) and you takes your chance, eh?

Nor can I find any reference to the Council issuing formal invitations to Tender for the work to be carried out. And I now learn that a local man, had he been made aware that the Council sought someone to carry out the work, would have been pleased to submit a Tender – and with some confidence, having it in mind to charge only the materials element of the work, donating the labour element to the Parish and the community.

And I note (from the December 2017 Newsletter) that the Council had previously obtained a workforce from a local Open Prison, when extensive repairs and resurfacing were carried out over a two week period. This labour was apparently free of charge. Why was this option not considered again in 2021, given the Council’s legal duty to safeguard public money?

My suspicious mind wonders whether of not the name MARSH might contain a duplicitous typo – I immediately thought of Councillor Shaun MARCH . . .

Alas, the story does not end here.

The Council does have some Financial Regulations in place, which are intended to ensure that this sort of financial irregularity can never occur. The Regulations clearly state:

Nowhere in Minutes can I locate any attempt to justify or mitigate this flagrant departure from the Council’s own Financial Control mechanisms, as set out in the Financial Regulations. It is clear that expenditure was incurred of an amount not included in the approved budget (breach of sub-section 1) and that expenditure was incurred that exceeded the revenue budget (breach of sub-section 2)

Even more shocking is the fact that the Council’s Internal Auditor, Mr Roger BRISLEY FCA, failed to register this mammoth departure and the obvious breaches of Financial Regulations, stating in his 2021/22 annual Audit Statement (dated 13th June 2022):

Mr BRISLEY’s oversight is so blatant as to suggest that either (i) he never diligently examined the 2021/22 Annual Accounts, (ii) his ineptitude is gargantuan, or (iii) he was an active party to the concealment of the unlawful disbursement of the unbudgeted ten grand.

Similarly, the Council’s Responsible Financial Officer (RFO) – the Clerk (i.e. the Chair’s daughter) did not identify this major financial problem. Perhaps she is immune to censure for ‘family’ reasons?

The Council’s Financial Regulations state, at 9.4:

Clearly, the Responsible Financial Officer (RFO) – the Clerk, mark you – acted in breach of the Council’s Financial Regulations and all members of the Council failed to ‘verify the lawful nature’ of the expenditure, or even to recognise that a major financial impropriety had taken place. And there appears to be no record of the Council consulting the Yorkshire Local Councils Association (YLCA) for advice, despite paying an annual subscription fee of £130 (not the £150 which appears in the Budget) for precisely such legal advice/guidance. Why not? Was the Council committed to concealing the irregularities even from the YLCA?

And it gets worse . . .

Contracts of this nature are also covered under Article 10 of the Council’s Financial Regulations:

It is clear that this ‘Footpaths Maintenance’ contract was not awarded in compliance with these Financial Regulations. I cannot find any reference to an “emergency”.

Thus, the record shows that £10,180.80 of expenditure was unlawfully authorised in direct breach of the Financial Regulations. Anyone troubling to examine the record, even superficially, can see this, and yet the paid ‘professionals’ – the Internal Auditor and the Responsible Financial Officer – have passed over it without comment. Even the Councillors – those ‘voluntary’ custodians of the public purse – have shown no concern. Why not?

Fortunately, civic-minded ‘whistle-blowers’ – Eric PICKLES’ “army of armchair auditors” – did, and so did the External Auditor. That July 2022 PIR, which focussed on very significant Governance failures, was both necessary and fully justified.

But it gets worse . . . far worse.

Consider, for example, s.137 of the LGA72 – ‘Limits of Expenditure’.

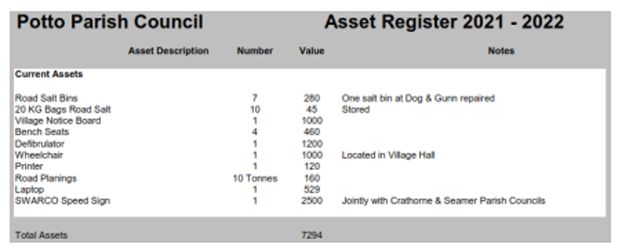

It is true that Parish Councils do have authority to spend public money maintaining public thoroughfares, such as this ‘bridleway’. However, when the asset is not owned by the Council (it is not on the Council’s 2020/21 Asset register – see below), siphoning off £10K amounts to fraud.

For absolute clarity, expenditure must be compliant with s.137 of the LGA72, which (according to the DLUHC) caps the Council’s expenditure for 2021/22 at £8.41 per elector. Given that there are approximately 220 electors, the total cap stands at just under £2K. Thus, the incurred bill of £10,180.80 (inc. VAT) for ‘Footpaths Maintenance’ is over 500% of the legal maximum, a massive breach of s.137. In point of fact, the money was spent unlawfully. This is fraud – a criminal offence and a legitimate matter for the North Yorkshire Police.

I cannot find where the ‘bridleway’ work order was approved by Council, or recorded in the Minutes – nor, indeed, any record of it ever having been brought into existence.

Furthermore, there is no record of a ‘value-for-money’ assessment and only one quote is recorded as having been considered, a clear breach of Section 3 (above).

Although Potto Parish Council does appear to have some of the appropriate mechanisms/procedures in place that aspire to being effective in regard to how projects are selected and financed, the WILDE regime has clearly ignored and/or circumvented them all. Why?

The November 2021 Minutes present a fait accomplit, making only an inappropriately brief reference to a proposed expenditure of 145% of the amount legally mandated under its own Budget.

Furthermore, Google reveals that Coxon Brothers of Bedale (declared ‘Dormant’, as of 31st December 2021 – only six weeks after receiving payment for the ‘bridleway’ work), was based at Exelby, near Bedale, which is in excess of 20 miles from Potto and entails approximately 30-40 minutes travelling-time. The reason for engaging this business is entirely opaque, unless (perhaps) it is the case that a prior personal relationship existed between the firm and one or more members of the Parish Council?

Google also confirms that there is a well-established civil engineering business based within the parish of Potto; Barnfather Construction Ltd (still very much ‘Active’, at the time of writing).

Mr BARNFATHER, I understand, lives within the parish – within spitting distance of this ‘ bridleway’. He has a maintenance workshop and storage depot, also within the parish, and he employs local labour. Why is there no record of Mr BARNFATHER having been invited to Tender?

My source in Hambleton informs me that Potto Parish Council Chair, Councillor Andrew WILDE, apparently has a ‘downer’ on Mr BARNFATHER, having submitted a series of complaints to HDC against him (none of which was upheld).

The Council’s December 2021 Minutes also record signs of an aversion to Mr BARNFATHER:

In short, a well-established local business and its local workforce was shunned in favour of a remote competitor. Perhaps this was driven by personal animus? Other possibilities also arise.

I am not alone in smelling a rat of prodigious proportions, as recent NYE Letters to the Editor attest. In “Potto: Where’s the Money? – [Pt.3]”, I will reveal its whereabouts.

Now, readers may feel that it has taken a disproportionate amount of scrutiny to expose a number of (some might say) ‘trivial’ unlawful actions on the part of an insignificant little Parish Council somewhere in the north of England, but it should be noted that the unbudgeted ‘bridleway’ and speed-sign expenditure totals over 205% of the total Annual Budget – i.e. well over £100 per household in extra Council Tax – which is far from trivial. There is nothing ‘paltry’ about £14,608.80.

Nevertheless, one can be certain that External Auditor PKF LITTLEJOHN will adhere to the letter of the law, should any future Objection be lodged by Potto electors, as indeed seems likely.

So it is not just about this £10,180.80 and £4,428.00 unbudgeted and unlawful spend. It is public money. The Council is accountable for it. It compounds the existing £47,170.99 in additional External Auditor Investigation charges – thus raising the unbudgeted total to £61,779.79 – approaching 1,000% of that year’s Precept income. Moreover, it may well risk further External Auditor Investigation charges for the 2022/23 Annual Accounts – and only a fool would be surprised if the 2022/23 Annual Accounts fare any better.

Just how much more should the ratepayers of Potto be forced to pay out, picking up the tab for the Parish Council’s extraordinary ineptitude – or corruption?

If this figure continues to rise at the current rate, it will soon top £1,000 in extra Council Tax for every Potto household. Whilst the Chair and his training-starved acolytes continue to fiddle around pretending to appeal an unappealable PIR, Potto taxpayers’ money continues to burn and the pleasure of gloating over the village’s ‘cool’ postcode will offer scant compensation.

The inescapable point to ponder is that all of the irregularities identified above fall outwith the scope of the July 2022 PIR and, in consequence, are virtually certain to trigger a host of valid Objections to the 2022/23 Annual Accounts.

The prospect of another PIR, with its concomitant Investigation fees, looms large indeed – which begs the question:

“What on earth did the ‘directing mind(s)’ of Potto Parish Council think they were playing at?”

In Pt.3, I intend to shed some much-needed light.

![Potto: “Where’s the Money?” [Pt.4]](http://nyenquirer.uk/wp-content/uploads/2023/03/POTTO_RECORDS-150x150.png)

![Potto: Where’s the Money? [Pt.3]](http://nyenquirer.uk/wp-content/uploads/2023/01/DENIAL-150x150.png)

Comments are closed.