Today’s Letter to the Editor, from regular correspondent WILLIAM PARKIN, responds to an article by NIGEL WARD published on the Enquirer under the title “SBC’s YCBID VAT Defense WRECKED!” on Monday 30th January 2023. It is uncanny how it is that whenever the BID company comes under closer scrutiny, its website mysteriously goes down (see below).

~~~~~

Dear Editor

Is the Yorkshire Coast BID VAT issue a bigger Monumental Pig’s Ear that the Council are trying to play down?

I refer to the article of 30th January 2023 regarding the treatment of the Levy Payments being collected by both Scarborough and East Riding Councils.

I am not an Accountant or a Solicitor. However, I do have a brain and common sense to know there is a problem. Also, the people directly involved are hoping it will just go away.

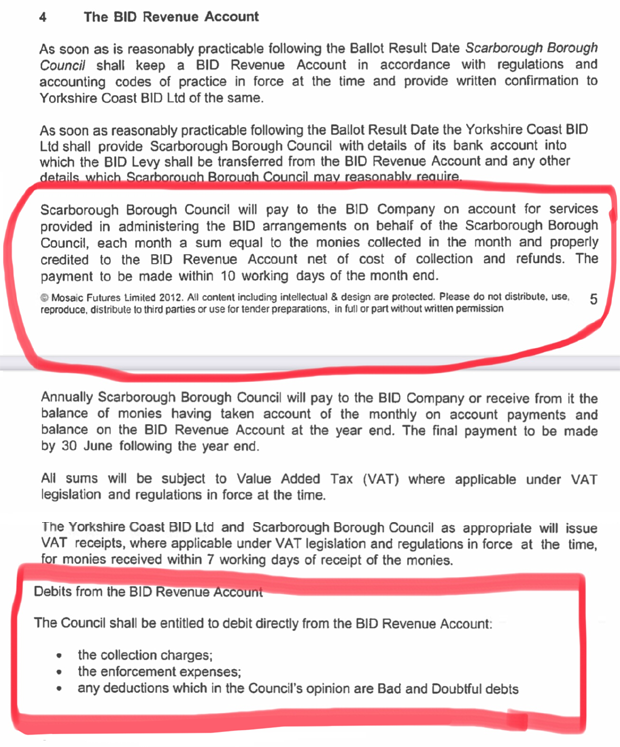

The formal BID agreement between the Council’s are:-

Within the Scarborough Council Operating Agreement, it specifically lays out how this should be undertaken.

This is to avoid the VAT complications that have been created and to keep it legal. This was pointed out by Mr Corrigan and his team over 3 years ago.

“To see the future, look to the past”.

Well-aimed questions by Mr Corrigan are now becoming clear.

With Scarborough Borough Council’s lead Solicitor, Mrs Dixon, inadvertently confirming that the Council is the Agent, she may be the person who closes the BID down and allows the Council to implement Article 18. It will be the same for East Riding of Yorkshire Council.

HM Customs & Revenue cannot turn a blind eye to this confirmation (and error); otherwise, it will have to let off hundreds of other businesses that have made errors.

As an Agent, and as the BID is VAT Registered, the Agent must apply the VAT status of the Business for which it is acting.

The reason for the legislation, and the wording in the agreement prepared by Mosaic, is to avoid the issue that has been present from day one.

To spell it out, my understanding of what should happen is:-

- The Council issues the Bills and as they are similar to the Business Rates charge, they do not attract VAT. From this money received, the Council deducts the cost of collection and any other costs/fees and pay over the net sum monthly to the BID.

- As the BID is providing a service to the Council, it issues an invoice for the net sum PLUS VAT. The Council claims the VAT element back in the usual manner and the BID pays the VAT to the Revenue – a net £nil transaction, Business to Business.

What has happened, and has been endorsed by both Councils and the BID Company within their Accounts, is:-

- Bills are issued on behalf of the BID Company. All the money is paid over with the VAT accounting above.

- The Council then issue Yorkshire Coast BID Limited an invoice for the collection costs and other fees as separate transactions. Both net £nil Business to Business transactions.

However, the difference is that the Levy-payers can claim an element of VAT on the Levy paid, as the Council has confirmed they are Collecting Agents for a VAT-registered Company. So, a payment of, say, £1,000 has a principal sum of £833.34 plus VAT of £166.66.

Are the BID company and/or the Councils going to have to explain to HMRC why they have not accounted for roughly £666,666 VAT on the roughly £4 million inclusive turnover that it should have received, 4 years into the 5-year term.

Therefore, I ask: has the BID Company reclaimed VAT on all its expenses, which it is not entitled to?

Surely, that would be grounds for both Councils to demonstrate there is insufficient funds to deliver its budget and can therefore start the Termination process set out in Article 18.

At this point, we do not know what Yorkshire Coast BID Limited proposes to do to sort it out? They may have ‘the elixir’ that no one knows about.

With both Councils’ Officers and the BID Company having endorsed by action the variation to signed contracts, it invalidates the operating agreements and, I would suggest, does not have a democratic mandate. Additionally, I would also suggest that Yorkshire Coast BID Limited does not have a mandate to run the BID on behalf of the Councils.

Also, how can anything proceed until the two validated objections with Mazars regarding the handling of BID money are sorted and it is finally confirmed that the bills issued are not illegal?

Finally, as already mentioned, the Councils’ ratepayers are lumbered with the £5,000 KPMG bill (plus VAT) that may not have asked the right question. Who will be accountable and will a Formal Reprimand be issued against the person/people responsible?

Yours faithfully,

William Parkin

Staithes

Travel arrangements?

Comments are closed.